- posted: Apr. 21, 2020

Concentrating an account in a specific security or industry, such as oil and gas, is risky. Not only is it a risky “strategy” but is tantamount to a speculative desire to “back up the truck” in the hope of significant gains while disregarding prudence and basic investment principle of diversification.

Failing to diversify investments in a portfolio can lead to a substantial risk of loss to principal. Stockbrokers/financial advisors often pitch returns without talking about the paramount factor of risk. Many times, conservative investors seeking moderate growth or fixed income are stunned when their portfolio is wiped out with losses.

Many investors were stunned to learn their portfolio incurred losses in excess of 90 percent due to the collapse of oil. Unsuitable investments may have been concealed for years due to the bull market run.

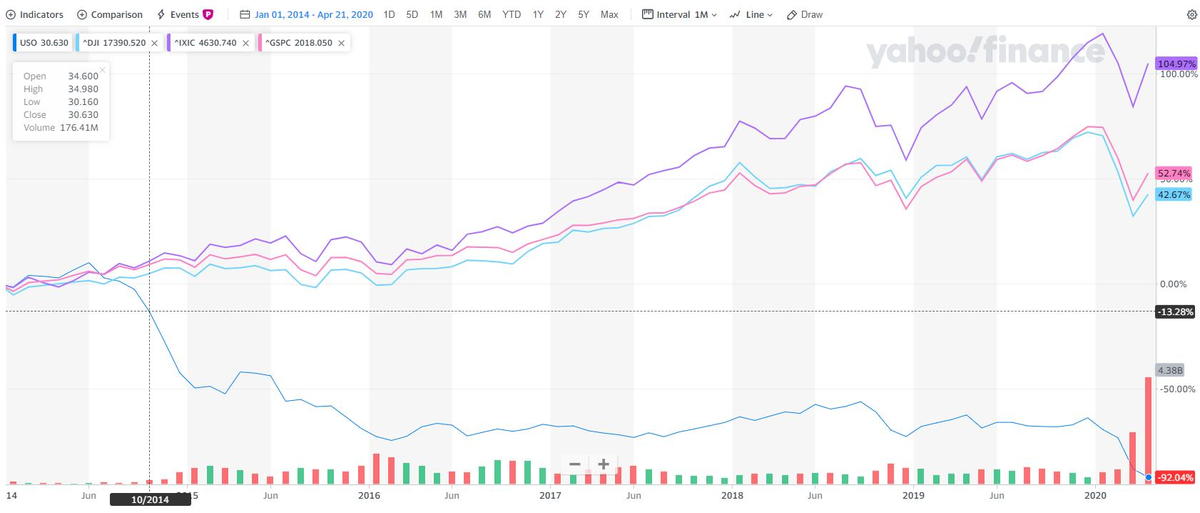

The above chart represents United States Oil Fund, LP (USO) compared to the DOW, S&P 500, and the NASDAQ indices for the last year. USO, an ETF designed to track the price of oil, which is reflective of the oil industry has fallen like a stone while the NASDAQ Composite is up 7%. A stockbroker/financial advisor may be hard-pressed to justify a concentration in any security, let alone one related to a commodity, such as oil. Another interesting point looking at the chart demonstrates that at no time did USO outperform any of the diversified indices.

Stockbrokers and Financial Advisors Had Knowledge of the Volatility of Oil

This chart illustrates the same securities beginning in 2014. In 2015, oil imploded, as demonstrated by the price of USO. One could only scratch one’s head why a stockbroker/financial advisor would recommend a concentration in oil knowing full well that a downfall is not unprecedented but a certainty. Any argument by a stockbroker/financial advisor that a collapse was unknown is not only intellectually dishonest but disregards the importance of diversifying.

Stockbrokers/financial advisors told investors that oil and gas securities were safe and designed for not only conservative growth investors, but many seniors seeking fixed income. Master Limited Partnerships were touted as providing significant fixed income despite the price of the securities.

Your Legal Options

Victims of concentration can make a claim for including but not limited to a breach of fiduciary duty, overconcentration, and failure to supervise. Arbitrations agreements mandate the forum to file a claim. For brokerage firms, FINRA is the appropriate place to bring a claim. Registered Investment Advisors often have an AAA arbitration agreement. If you are an investor who has any concerns about your investments, please contact attorney David Harrison at (310) 499-4732 for a no-cost and no-obligation evaluation of your specific facts and circumstances.